Markaz: Q Holding secures the leading transaction in 9M 2023 after revealing plans to merge ADQ Real Estate and Hospitality Investments and IHC Capital Holdings’ assets under the Q Holding umbrella.

Q Holding leads the top GCC M&A transactions during 9M 2023 as per a report recently issued by the Investment Banking Department at Kuwait Financial Centre “Markaz”. The report highlights the USD 7.0 billion transaction that was announced by the Emirati company whereby it revealed its plans to merge ADQ Real Estate and Hospitality Investments and IHC Capital Holding's entities, including Modon Properties, Abu Dhabi National Exhibition Company, and various other assets under the Q Holding umbrella.

In the second position, Jazan Integrated Gasification and Power Company secured the second-largest transaction by finalizing its acquisition of the Jazan Integrated Gasification Combined Cycle (IGCC) plant from Saudi Aramco, valued at USD 4.8 billion. The acquisition was phased out with the first group of IGCC assets acquired for USD 7.2 billion on the 18th of October 2021 financed through senior debt facilities. The Saudi Public Investment Fund took on the following transaction, penning a binding agreement with Saudi Basic Industries Corporation to acquire the shares of Saudi Iron and Steel Company, for a total estimated enterprise value of USD 3.3 billion, with the final sales price to be disclosed as the closing date approaches. Moreover, Brookfield Asset Management and the consortium of CVC Capital Partners Limited and Francisco Partners submitted substantial billion-dollar bids with intentions to acquire UAE's Network International. Initially, CVC Capital and Francisco Partners jointly presented a cash offer of 387 pence per share, totalling approximately USD 2.7 billion for the complete 100% ownership of Network International. Subsequently, following this announcement, Canadian-based Brookfield Asset Management also submitted a non-binding offer to acquire the entire Network International at a rate of 400 pence per share, estimated to be around USD 2.7 billion. Lastly, Fairfax Financial Holding Company Limited announces intentions to acquire an additional 46.3% stake in Gulf Insurance Group for KD 263.7 million (USD 858.4) from Kuwait Projects Company Holding. Post transaction, Fairfax will be the largest shareholder in Gulf Insurance Group owning approximately 90.0% of the company.

GCC M&A Decline

According to Markaz’s report, the GCC market sealed a total of 128 transactions throughout 9M 2023, which implies a decline of 22% year over year. United Arab Emirates claimed the lion’s share with 77 closed transactions, followed by Saudi Arabia closing a total of 30 transactions. Apart from Qatar and Saudi Arabia, all other markets in the region saw a substantial year-over-year decline in their M&A activities.

Acquirers and Targets

Consistent with historical trends, the majority of transactions completed in both the initial nine months of 2023 and 2022 were carried out by acquirers from the GCC. Specifically, during the first nine months of 2023, GCC acquirers took the lead, being responsible for a substantial 73% of the total completed transactions, leaving foreign acquirers with a 27% share. GCC acquirers also dominated the market during the initial three quarters of 2022 as they accounted for 71% of the total number of closed transactions with foreign counterparts contributing a noteworthy 24%. The residual 6% encompasses transactions for which the buyers remained undisclosed.

Furthermore, GCC acquirers primarily invested in companies within their local markets and in international markets, and targeted regional companies to a lesser extent. Throughout 9M 2023, GCC acquirers closed a total of 80 transactions within their local markets, compared to 99 transactions in 9M 2022[1]. In addition, GCC acquirers sealed 63 cross-border transactions throughout 9M 2023, relative to 64 cross-border transactions in 9M 2022. It's noteworthy that UAE buyers spearheaded the cross-border activity, representing approximately 60% of the total number of closed cross-border transactions, while Saudi Arabia and Qatar followed, contributing 19% and 13%, respectively.

Foreign Buyers

Shifting focus, it is worth mentioning that GCC targets experienced a slight decrease in foreign buyer interest during this period. They concluded a total of 34 transactions, which was marginally lower than the 39 transactions in the preceding year, marking a 13% year-over-year decline. Notably, UAE targets continued to be the prime attraction for foreign buyers, finalizing 25 transactions in the initial three quarters of 2023.

Sectorial View

Moreover, the deals concluded in the first three quarters of 2023 were directed towards companies spanning diverse sectors, emphasizing a consistent trend observed in recent quarters. That said, the Consumer Discretionary, Industrials, and Information Technology sectors stood out as the most active, collectively contributing to 37% of the transactions completed during this period.

Deals in the Pipeline

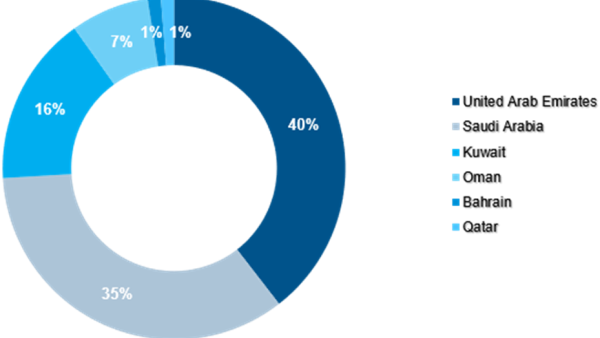

By the end of the initial three quarters of 2023, there were a total of 81 announced transactions in the pipeline, marking a substantial reduction compared to the preceding year when the pipeline saw a total of 100 announced transactions. The majority of these transactions involved United Arab Emirates targets, who accounted for 40% of the total number of announced deals, followed by Saudi Arabia and Kuwait at 35% and 16%, respectively. The remaining transactions involved Omani, Qatari, and Bahraini targets. Apart from Oman, all the other markets experienced a substantial reduction in activity compared to the same period in 2022.

Top 5 M&A Deals by Reported Value* – 9M 2023

Target Company | Target Country | Buyer | Buyer Country | Percent Sought | Deal Value (USDmn) | Status |

Modon Properties PJSC, Abu Dhabi National Exhibition Company, and other assets | United Arab Emirates | Q Holding | United Arab Emirates | 100 | 6,976** | Announced |

Assets of Jazan Integrated Gasification Combined Cycle Project | Saudi Arabia | Jazan Integrated Gasification and Power Company | Saudi Arabia | - | 4,800 | Closed |

Saudi Iron & Steel Company (Hadeed) | Saudi Arabia | Saudi Public Investment Fund | Saudi Arabia | 100 | 3,329 | Announced |

Network International Holdings plc | United Arab Emirates | Brookfield Asset Management Ltd. / CVC Capital Partners Limited; Francisco Partners Management, L.P. | Canada, Luxemburg, United States | 100 | 2,748 / 2,661*** | Announced |

Gulf Insurance Group K.S.C.P. | Kuwait | Fairfax Financial Holding Company Limited | Canada | 46 | 858 | Announced |

Source: S&P Capital IQ, GCC Stock Exchanges, Local Newspapers, Markaz Analysis

*Top deals were chosen based on transactions, which had all necessary information provided.

**The transaction value is an estimate and was calculated based on the following assumptions: (1) Convertible shares of 9.5 billion in Q Holding (2) Convertible price of AED 2.7 per share.

***The transaction value is an estimate and was calculated based on the following assumptions: (1) issued shares based on the annual report 2022: 552,291,780 shares (2) Brookfield Asset Management bid 400 pence per share (3) CVC Capital Partners and Francisco Partners Management Consortium bid 387 pence per share

Number of Closed GCC M&A Transactions*

Country | 9M 2023 | 9M 2022 | % Change (YoY) |

Bahrain | 3 | 9 | -67% |

Kuwait | 7 | 22 | -68% |

Oman | 5 | 8 | -38% |

Qatar | 6 | 3 | 100% |

Saudi Arabia | 30 | 30 | n/a |

United Arab Emirates | 77 | 92 | -16% |

Total | 128 | 164 | -22% |

Source: S&P Capital IQ, GCC Stock Exchanges, Local Newspapers, Markaz Analysis

Classification of Deals by Sector – 9M 2023

Sector | GCC Acquirers | Foreign Acquirers | Grand Total | %* |

Consumer Discretionary | 2 | 16 | 18 | 14% |

Industrials | 5 | 12 | 17 | 13% |

Information Technology | 2 | 11 | 13 | 10% |

Healthcare | 5 | 7 | 12 | 9% |

Communication Services | 3 | 8 | 11 | 9% |

Energy | 4 | 6 | 10 | 8% |

Financials | 1 | 7 | 8 | 6% |

Materials | 3 | 5 | 8 | 6% |

Insurance | 0 | 7 | 7 | 5% |

Education | 1 | 4 | 5 | 4% |

Utilities | 2 | 3 | 5 | 4% |

Real Estate | 0 | 4 | 4 | 3% |

Consulting | 2 | 2 | 4 | 3% |

Consumer Staples | 1 | 2 | 3 | 2% |

Logistics | 1 | 2 | 3 | 2% |

Total | 34 | 94 | 128 | 100% |

*Totals may exceed 100% due to rounding.

Geographical Distribution by Number of Announced Pipeline Transactions (9M 202

3)

Background Information

Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.03 billion as of 30 September 2020 (USD 3.33 billion). Markaz was listed on the Boursa Kuwait in 1997.