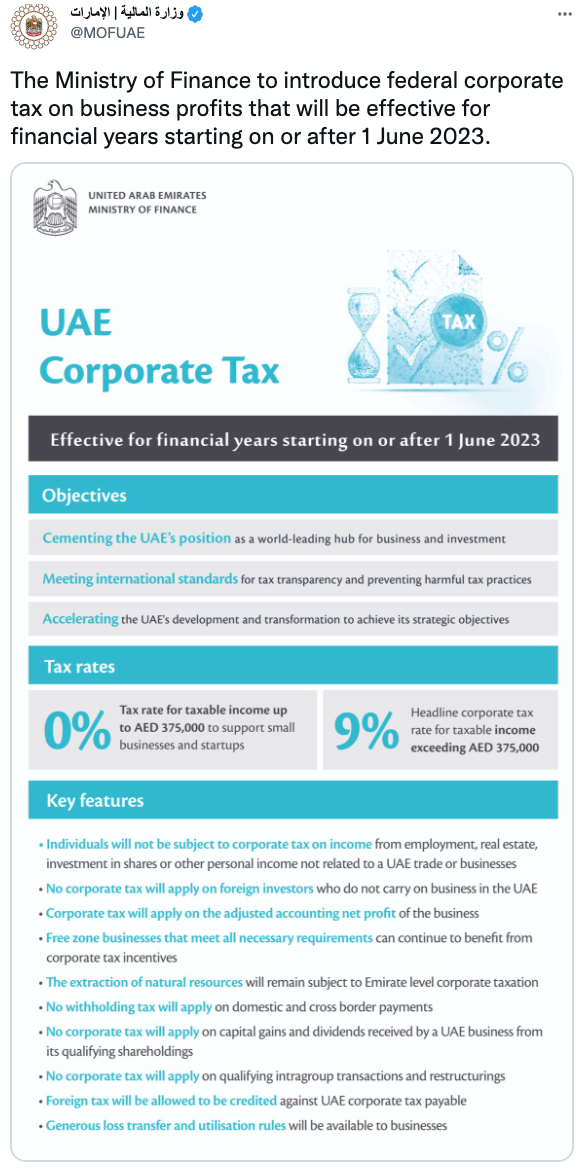

The United Arab Emirates will be introducing a 9% federal corporate tax on business profits for the first time starting June 2023, the country's Ministry of Finance announced on Monday.

According to the ministry's announcement, there will be no tax on profits of up to Dh375,000 ($102,100), in a move that aims supporting small businesses and startups.

The announcement also clarified that no corporate tax will apply on personal income from employment, real estate and other investments, or any other income earned by individuals that do not arise from business or other forms of commercial activity, licensed or otherwise.

On the other hand, firms that are operating in the country's free zones can “continue to benefit from corporate tax incentives” as long as they “meet all necessary requirements,” the ministry said.

"As a leading jurisdiction for innovation and investment, the UAE plays a pivotal role in helping businesses grow, locally and globally. The certainty of a competitive and best in class corporate tax regime, together with the UAE’s extensive double tax treaty network, will cement the UAE’s position as a world-leading hub for business and investment", said Younis Haji Al Khoori, Undersecretary of the Ministry of Finance.

"With the introduction of corporate tax, the UAE reaffirms its commitment to meeting international standards for tax transparency and preventing harmful tax practices." he added.

Corporate Tax in UAE

It's worth noting that up until now, UAE’s 20% corporate taxes only applied to banks and insurance companies. In addition, individual emirates have already impose a limited corporate tax on enterprises engaged in exploration and production of oil and gas at rates up to 55%.

On January 1st 2018, Value-Added Tax (VAT) was introduced across the UAE at a standard rate of 5%.