Building a Framework for Innovation in the Retail Power Sector: Deloitte Report

Utilities around the world face constant disruption – evolving customer habits and expectations, and emerging technologies are transforming markets at dizzying speeds. As barriers-to-entry plummet and new business models emerge, retail power providers face an existential threat. However, a new report from Deloitte Insights, “Widening the aperture: big-picture thinking on disruptive innovation in the retail power sector,” finds that many retail power providers are not responding to these threats with adequate urgency.

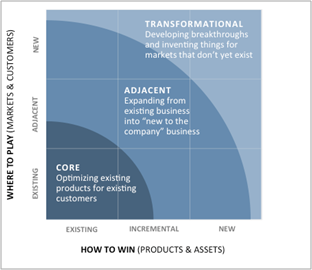

If retail power providers are to survive and compete amid this turbulent environment, they must rethink their approach to innovation. Monitor Deloitte presents three “ambition levels” for evaluating a company’s commitment to innovation: core, adjacent, and transformational.

Figure: Innovation ambition levels

Source: Geoff Tuff and Steven Goldbach, Detonate: Why and How Corporations Must Blow Up Best Practices (and bring a beginner’s mind) to Survive, May 8, 2018, https://www.amazon.com/Detonate-Corporations-Practices-beginners-Survive/dp/1119476151

“For many retail power providers, the vast majority of innovation is still focused on core operations—making established products and services better, rather than expanding into adjacent segments or businesses, or inventing brand-new products or services for markets that don’t exist yet,” says Bart Cornelissen, Partner and Energy & Resources Leader, Deloitte Middle East and Managing Partner of Monitor Deloitte, Middle East. “This narrow approach to innovation can cause retail power companies to overlook both risks and opportunities, leaving them open to potential disruption from new market entrants and new business models from existing competitors. To keep pace, retail power providers must focus more heavily on adjacent and transformational innovations, creating new business opportunities and expanding markets.”

“Given the GCC countries’ high energy intensity and channels of use, it is important for the retail power sector to ensure their business model allows them to remain relevant to their customers’ needs and rapidly changing demands of the energy ecosystem, to maintain value for its shareholders,” said Adnan Fazli, Director and Energy & Resources Leader, Financial Advisory, Deloitte Middle East.

According to the report, retail power companies remain vulnerable to five blind spots resulting from a narrow approach to innovation:

- Cyber threats: While most retail power providers are aware of cyber threats, some may be underestimating what it takes to stay ahead of the risks. The threat landscape will become even more complicated as the retail power sector increasingly adopts smart technologies, leverages Internet of Things, and digitizes its back-office systems. As threats become more complicated, so too should the pace of cybersecurity innovations.

- Regulatory environment: In much of the world, the utility regulatory structure has not caught up with disruption in the sector. Retail power providers will increasingly need to see the regulatory environment as an opportunity for collaborative innovation.

- Rapid development of battery storage technology: Rapid innovation in the battery storage technology space has led to the emergence of new business models that aggregate customer-sited storage to provide a range of services to utilities, grid operators and electricity customers. Aggregation powered by artificial intelligence, blockchain, and predictive analytics could provide greater flexibility for utilities and developers and greater choice for residential, commercial, and industrial customers. It could also demand more effort and investment from retail power providers, who will need to stay abreast of developments and figure out where to play in this space.

- Ecosystem convergence: Electric vehicles straddle the automotive and the retail power sectors. Smart cities blend Internet of Things (IoT), microgrids, renewable power, self-driving vehicles, energy management, and battery storage, among other technologies. As these ecosystems converge, what is the role of the power provider? A leader, integrator and innovator—or a pipes and wires provider? Some retail power companies are testing the extent of ecosystem convergence through pilot projects. Others have yet to enter this space and are likely missing an important opportunity to compete on a whole new playing field.

- New market entrants: Technology is bringing new players and more competition into the value chain. By making it easier for companies to implement new business models, technology is inviting not only start-ups but also established players from adjacent industries to enter the retail power sector. Retail power providers will need to discover new ways of creating value to stand out from the crowd.

“Retail power companies have a choice – disrupt or be disrupted,” continues Cornelissen. “By broadening their innovation strategies with the help of new technologies, organizations can avoid being blindsided while finding new ways to grow.”

Background Information

Deloitte

We believe that we’re only as good as the good we do.

All the facts and figures that talk to our size and diversity and years of history, as notable and important as they may be, are secondary to the truest measure of Deloitte: the impact we make in the world.