US dollar back on the rise as oil prices struggle with basic market dynamics

ALBAWABA – Oil prices fell on Thursday, extending losses from the previous session, as the US dollar bounced back from its lowest point in over a year and oil flows from the United States (US) weighed on the market.

Brent futures were down $0.48, at $80.70 a barrel at 0630 GMT, according to Reuters, and US West Texas Intermediate crude (WTI) dropped $0.53, at $76.13 a barrel.

Both benchmarks fell more than 1.5% in the prior session.

Meanwhile, the US Dollar gained against its peers of major currencies, with the Bloomberg Dollar Index up 0.12 percent on Thursday, at 104.5200.

The US dollar rallied for weeks ahead of the release of US inflation data earlier this week, with the Consumer Price Index (CPI) inflation rate slowing by the most in months.

Slowing inflation indicates the Federal Reserve will not be hiking US interest rate hikes, at least for now.

US treasury yields dropped and the greenback fell significantly on the news on Tuesday, but soon picked up again as more experts challenged the prospects of a rate cut coming in early in 2024.

Many dollar bulls remain undaunted despite a painful day of trading after soft inflation data sent Bloomberg’s gauge of the US dollar tumbling by the most in a year.

The Australian dollar rallied the most since January in the wake of the report, while the euro enjoyed its biggest intraday move in a year, Bloomberg reported.

According to the New York-based news agency, T. Rowe Price says bets on Federal Reserve rate cuts next year are overblown. They expect growth in the US and higher interest rates versus other major economies to support the US dollar.

Meanwhile, Fidelity International sees that those higher-for-longer US interest rates risk dragging the economy into a downturn that would benefit the US currency.

Oil prices are affected by the strength of the US dollar, oil supply and demand - Shutterstock

On the other hand, Western Asset Management says demand for Treasuries and the greenback’s status as the world’s reserve currency will bolster the case for US exceptionalism.

Oil prices sink on prospects of weaker demand, US offsetting tight supplies

US crude stocks rose by 3.6 million barrels last week to 421.9 million barrels, according to the US Energy Information Administration (EIA). This is much higher than the analysts’ expectations in a Reuters poll for a 1.8 million-barrel rise.

The oil market has been weighing differing views on supply and demand, according to Bloomberg.

The International Energy Agency said Tuesday that global oil markets will likely not be as tight as expected this quarter, with production growth in the US and Brazil beating forecasts.

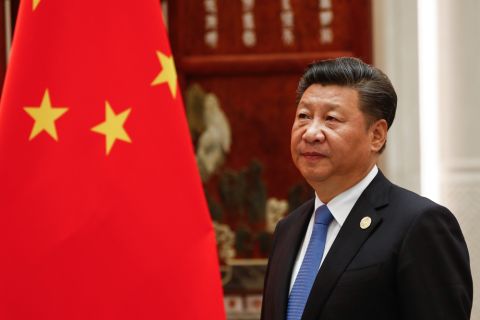

This came after a more upbeat assessment from OPEC that highlighted robust growth trends and healthy fundamentals, which was bolstered by surprising economic data from China.

Signs of China’s economy recovering supported oil prices Wednesday, but a stronger US dollar weighed on oil prices, along with higher-than-expected US stockpiles.

Still, demand is expected to pick up. Especially with the drawdown in US product inventories signalling stronger demand for gasoline, diesel and jet fuel, according to Rob Thummel, portfolio manager at Tortoise Capital Advisors.

“Ultimately, that means refiners are going to buy more oil to produce refined products and that demand for oil ultimately will likely rise,” he told Bloomberg.

Oil prices fell to a three-month low last week, Bloomberg reported, after shedding all of the risk premium from the conflict in Palestine, with the Israeli onslaught on Gaza still ongoing.