ALBAWABA – Almost all major crude and gas companies are developing new fields that the International Energy Agency (IEA) consider unnecessary, even as oil prices fluctuate over tighter supply and growing demand worldwide.

This comes as IEA’s forecasts are finally aligning with those of the Organization of Petroleum Exporting Countries and its allies (OPEC+) for stronger global oil demand towards the end of 2023.

Germany's Urgewald, along with 50 other NGOs, analysed the investment plans of 1,623 companies involved in the oil and gas, representing 95 percent of the global hydrocarbon industry.

Of the 700 companies that produce oil and gas, 96 percent are developing or plan to develop new fields, the Global Oil and Gas Exit List (GOGEL) said, as reported by Agence France-Presse (AFP).

Spending on new oil and gas fields has risen 31 percent since 2021, with the companies investing a total $170.4 billion during that period, according to AFP.

However, the IEA said in September that given the development of renewable energies, there is no need to invest in new reserves of coal, oil or natural gas.

Since then, oil prices have retreated below the $100-threshold, for the most part, but fears of further tightening supplies, against stronger demand fan the fire of concern.

All of the major oil companies, including shell, are investing in hydrocarbon fields to diversify sources as oil prices fluctuate due to tightening supplies after Saudi Arabia and Russia announced maintaining cuts until the end of the year - Shutterstock

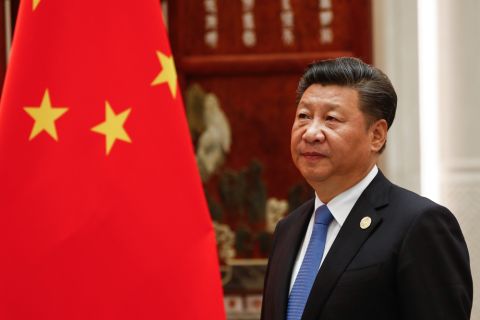

Oil prices rose Wednesday on the heels of stronger-than-expected economic data from China, and prospects of the Chinese economy recovering seemed more viable, with economists expecting the world’s second-largest economy to hit its 5 percent growth target for 2023. Especially after the government announced it is considering additional funds to support the debt-laden property sector.

Meanwhile, Saudi Arabia and Russia have both announced maintaining oil cuts until the end of the year, which is tightening supply and bolstering oil prices.

Overall, companies and hydrocarbon reliant countries are looking for other sources of fossil fuel to shore up their energy needs for the coming years. Instead of relying on Saudi Arabia and Russia, and their oil-producers’ club.

Urgewald's report highlighted three Chinese companies, China National Petroleum Corporation (CNPC), CNOOC and Sinopec, as well as the national Saudi company Aramco, Mexico's Pemex, the US's Pioneer Natural Resources, and the Anglo-Dutch company Shell.

According to the report, 1,023 companies plan infrastructure projects for the transport of fossil fuels, such as pipelines and liquefied natural gas terminals.

Urgewald estimates that 539 companies – Including Saudi Aramco, QatarEnergy and Russia's Gazprom are preparing to produce an extra 230 billion barrels of oil in the next one to seven years.

Notably, rising oil prices since Russia invaded Ukraine have caused energy costs to skyrocket, stoking a tidal wave of inflation on a global scale.