ALBAWABA – Oil prices fell on Wednesday ahead of the United States (US) Thanksgiving holiday as the US dollar rose and markets held out for the Organization of Petroleum Exporting Countries and its allies’ (OPEC+) decision next Sunday, as to whether additional cuts are in order.

Meanwhile, traders are also waiting for confirmation of a sharp build-up in US crude stocks, according to Reuters.

Brent crude futures fell $0.52 to $81.93 a barrel by 0946 GMT, Reuters reported, and US West Texas Intermediate crude futures were down $0.49, at $77.28.

Both benchmarks have fallen for four straight weeks, overall, with the intermittent spikes that have helped reinforce oil prices within the comfort zone.

Investors remained cautious ahead of Sunday's scheduled OPEC+ meeting as the producer group will discuss deepening supply cuts due to slowing global economic growth.

On Monday, both contracts climbed about 2% after three OPEC+ sources told Reuters the group is considering more supply cuts.

Crude has been buffeted in recent weeks by indications that non-OPEC supplies are expanding, Bloomberg reported.

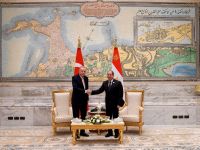

Oil prices are affected by demand and supply dynamics and the strength of the US dollar - Shutterstock

Widely watched time-spreads show a weakening market, with the gap between the nearest two contracts for Brent and WTI in a bearish contango pattern — when longer-dated prices are more expensive than prompt or nearer contracts.

Brent’s prompt spread was $0.04 a barrel in contango, compared with more than $1 a barrel in the opposite, bullish backwardated structure a month ago, as reported by Bloomberg.

The US dollar ticked higher on Monday, with Bloomberg’s dollar index up 0.15 percent at 103.7190.

Looking forward, even if the OPEC+ nations extend their cuts into next year, the global oil market will see a slight supply surplus in 2024, the head of the International Energy Agency's (IEA) oil markets and industry division said on Tuesday.

To support prices, OPEC+ will need to not only extend, but increase cuts, said John Evans of oil broker PVM in a note on Wednesday.

US crude stocks rose by nearly 9.1 million barrels in the week ended Nov. 17, according to Reuters’ market sources citing American Petroleum Institute figures on Tuesday. Whereas gasoline inventories dropped by about 1.79 million barrels and distillate inventories fell by about 3.5 million barrels.