Graphite deficit of 7.7k tonnes forecast by 2030

ALBAWABA – A Reuters report, published Wednesday, highlighted that automakers, including Tesla and Mercedes, are aggressively competing to secure supplies of graphite from sources outside of China.

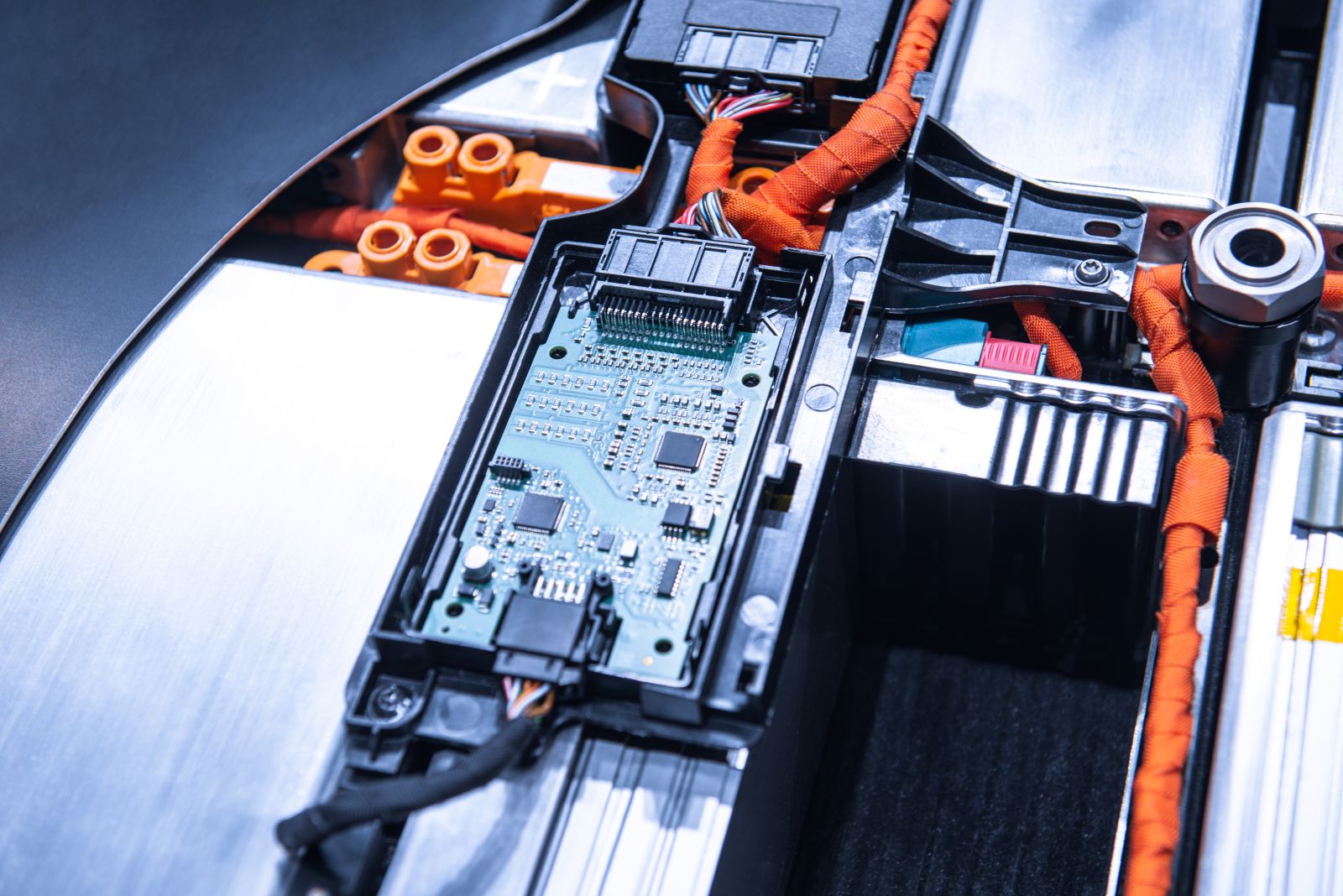

EVs are expected to account for over 50 percent of the natural graphite market this year, the report underscored.

The industry’s procurement focus suddenly shifted from lithium and cobalt to graphite.

China’s domestic EV market started off strong this year. But local demand has seen a decline in the last few months, which has prompted the government to introduce a four-year $72 billion tax breaks package on EVs to stimulate demand.

China currently dominates the graphite market, producing 61 percent of the global natural ore and 98 percent of the final processed material used in EV battery systems, according to Reuters.

Notably, it is the largest component by weight in EV batteries, the report highlighted. Every EV requires 50-100 kilograms of graphite, roughly twice the amount of lithium.

Automakers in the West have been late in planning for graphite shortages.

More so, did not factor in the latest Chinese government’s EV stimulus, which may drive domestic demand in China through the rough, crunching on global graphite supplies.

Meanwhile, current legislation in the United States and Europe aims to reduce reliance on China for critical minerals, including graphite.

However, companies find themselves facing a dilemma, due to the lack of investment in non-Chinese graphite sources, the report said.

Talga Group from Australia, which owns a mine in Sweden, is among the new producers trying to fill this gap. It is seeking supply deals with Tesla, Toyota, Ford, and battery producers like Northvolt.

The report indicates that by 2030, there will be a global supply deficit of 777,000 tonnes. To meet the demand, $12 billion of investment and 97 new mines are required by 2035.

Another factor driving Western demand for graphite is the increasing focus on environment-friendly solutions.

Western automakers are considering natural ore due to its lower carbon footprint compared to synthetic graphite derived from petroleum products, Reuters explained. Natural graphite anodes are also more cost-effective and enhance cell capacity and power output.

In the long term, it could face competition from silicon as an anode material, which allows EVs to drive longer distances before recharging. However, currently, the use of silicon is limited as it expands during use and can degrade the battery.