Let's assume that you want to increase your investment in the crypto market, but you're not sure when is the optimum time to do so considering the high volatility the crypto market is facing now. Since neither you nor we are fortune-tellers, the dollar-cost averaging (DCA) investment plan is the mathematically smartest way to do this.

Until this point, trading during a global crisis has been tiresome and terrifying even to the most seasoned traders. Nonetheless, it wasn't an out-of-the-blue situation as anyone who has followed the crypto news for a while has already seen some of the troubles that have swept the crypto as well as the global markets.

While the bulls are trying to gain back control of the market's dip train, there is only one problem; that train has already left the station.

As the darkest and hardest-to-survive phase of the bear market reaps further misery, DCA didn’t only prove its mettle in helping traders buy crypto wisely but also helps to cushion the economic blow or such downturns of the markets.

In this article, we’ll explain the know-how of this strategy which focuses more on the time in the market rather than market timing.

What Is Dollar-Cost Averaging?

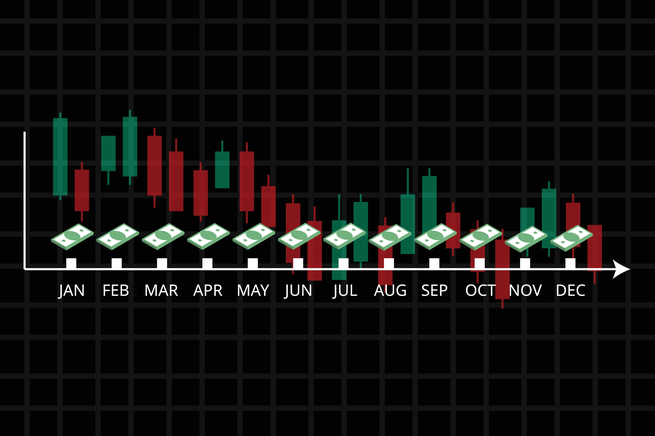

Dollar-cost averaging (DCA) is an accumulation investment strategy in which an investor distributes the entire amount they allocated for investing over periodic purchases of the targeted crypto asset to lessen the overall impact of volatility. So, purchases are made at regular intervals regardless of the asset's price.

In simple words, to implement the Dollar-Cost Averaging (DCA), the investor splits the whole investment amount and buys the target cryptocurrency in time intervals. This can be done once a week, once a month, once a quarter, or whenever is most convenient for you.

How Can Dollar-Cost Averaging Help You Build Your Crypto Wealth Whilst on A Budget?

Painting a picture for those who are not keeping up, the charts looking bloody red with the total market cap under $1 trillion and bitcoin slid to lows of more than 60% of its value since ATH, things went from bad to worse and there’s no denying that current market sentiment is bearish.

While some traders think that they should slam the brakes on their purchasing plans, especially since they’re now realizing significant losses during this market meltdown that shows no sign of slowing down, with little to cheer about, it’s a perfect time to buy crypto using the Dollar-Cost Averaging strategy (DCA).

Many traders are now resorting to Dollar-Cost Averaging (DCA) to pave their way into crypto- it’s tried and tested strategy which allows them to make tiny repeated purchases to reduce price volatility and encourage long-term investing habits.

For example, meet John. John has invested $100 in Bitcoin every week beginning on December 18, 2017, around the all time high of the bull market that year, he would have invested a total of $16,300. John’s portfolio would be valued roughly $65,000 by January 25, 2021, representing a return on investment of more than 299%.

While, if John had invested the same $16,300 on December 18, 2017, he would have lost approximately $8,000 in the first two years. Of course his portfolio would rebound, but he would have missed out on the opportunity to multiply his earnings and may have even terrified to foray again into the crypto market.

It is vital to remember that dollar-cost averaging works well only if the asset's value improves throughout the course of time. Dollar-cost averaging improves an investment's performance over time, but only if the investment's price rises. The technique cannot shield the investor from the risk of falling market prices.