The most seductive argument in the investment universe at the moment is that the liquidity pouring into global financial markets guarantees a continued rally into the distant future. The problem surely is that this scenario is exactly what markets now expect. Have they just discounted the best scenario and ignored every other possibility?

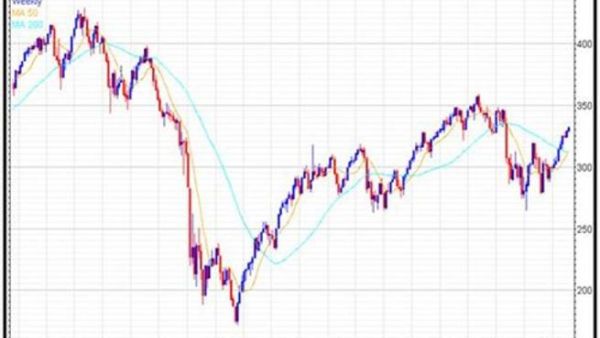

If so then this is a dangerous time rather than one for monumental complacency. We still look at the global stock market rally from the low of March 2009 and see a head-and-shoulders pattern, and we seem to be sitting on the top of the last shoulder:

You have to ask then what could tip this market up? Well the oil price is sounding loud alarm bells. So too is the deteriorating politics of the Middle East towards a strike by Israel on Iran. They are not unconnected.

Stock markets too are hesitating to rise further and seem stuck around current levels. You also need to find a big bull lever to pull prices higher. Small but positive indications of growth in the US may not be enough while the Chinese economic miracle is showing signs of stalling.

Central bank action

Money printing is also not necessarily a natural boost to stock markets. If the money finds its way into commodity speculation then this is a cost pressure on the profits of manufacturers and a tax on consumers through higher gas prices.

The eurozone sovereign debt crisis is also far from done in Greece and it looks like Portugal will be the next country to ask for special treatment. Again this will be a drain on the new liquidity provided by the central banks, it does not necessarily rush to boost stock markets.

Is there much money to be made by running ahead of a steamroller? We note that IPOs are coming back into fashion. They are another market topping indicator. You usually only IPO when you think prices are high. The IPO window could be exceptionally small this season.

War mongers

We are not happy gambling on what trigger-happy Israelis might or might not do in cohoots with their friends on Wall Street, and only those confident on being on the rightside of that trade should be holding stocks now.

That said the ArabianMoney investment newsletter is already looking forward to the next rally and will have some exciting ideas on how to profit from it in the next issue.