ALBAWABA – The central banks of the European Union (EU), Canada, Australia, and Japan, as well as the United Kingdom (UK) are all scheduled to review their interest rates policies this month, following the United States (US) Federal Reserve (Fed)'s decision this week, whose Board is slated to meet June 13.

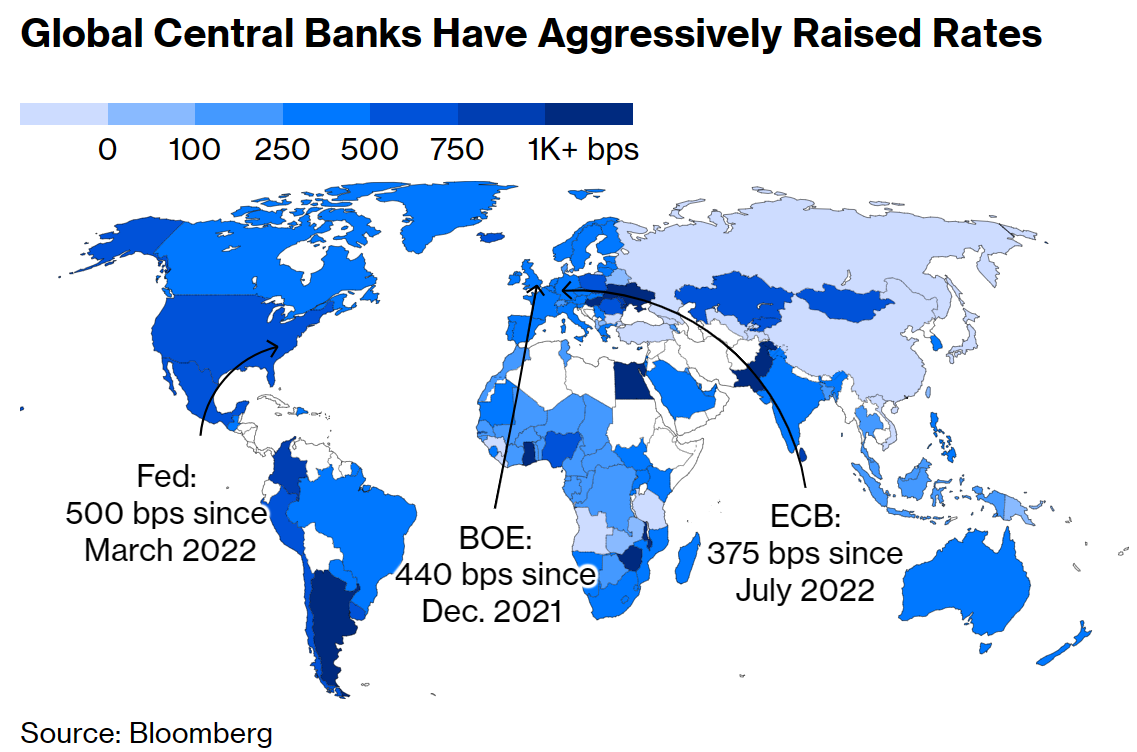

Several central banks have raised interest rates over the past year, the latest being the central banks of Canada and Australia, last week, following in the footsteps of the Fed.

Since March 2022, the Fed raised interest rates in the US by nearly 5 percent, in an effort to curb inflation. Likewise, many central banks around the Arab World, Europe, Australia, Japan, Canada, and elsewhere have also had to raise rates.

In the next couple of weeks, the central banks of the US, Australia, Canada, and Japan, are all scheduled to convene on their regular policy meeting this month. Upon meeting, they will each decide whether or not they will introduce another hike to their interest rates.

The central Bank of Canada has not raised interest rates since January, until faced with the unavoidable inevitability, June 8. With inflation still accelerating at the time, the bank decided to raise interest rates by 25 basis points, to 4.75 percent.

The Federal Bank of Australia, as well, raised interest rates by a quarter-point to an 11-year high last week, according to Reuters.

Meanwhile, central banks around the world face insurmountable challenges in the weeks to come, as markets respond surprisingly to the streak interest rates.

US interest rates

In fact, some experts expect the Fed to raise interest rates to 6 or 6.5 percent before the end of the year.

While inflation may have begun to show signs of deceleration in April and May, slightly, the job market in the US is still hot.

Labor markets remain strong as businesses cling to workers amid fears they may not be able to rehire them when needed, Bloomberg reported.

More so, pent-up pandemic savings continue to underpin consumer demand, the New York-based news agency underlined.

Maintaining the course means further growth in salaries and the housing market.

This may not be healthy for a recovering economy, Moreover, RBA’s Philip Lowe told Bloomberg.

Another issue to consider is the performance and policies of the banking sector in light of the recent collapse of multiple regional banks in the US.

Fed officials have repeatedly said that it is too early to determine whether the interest rates hike policy is a success, but they insist that it is the best way to go.

“A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle,” Fed Governor Philip Jefferson, who’s been nominated to be vice chair, said on May 31 speech in Washington.

According to Agence France-Presse (AFP), the Federal Open Market Committee (FOMC), the Board responsible for configuring interest rates, remains divided going into the meeting on June 13-14.

Some of the members of the board, a minority, as per AFP; are still pushing for an 11th straight hike, as inflation remains stubbornly above the Fed's long-term target of two percent.

Compared to Bloomberg, AFP’s interviewees are optimistic.

"There is enough support within the community for that pause," EY senior economist Lydia Boussour told AFP, i.e. a pause on interest rate hikes.

Fed chair Jerome Powell has previously indicated they may vote to hold the benchmark lending rate, i.e. interest rates, at the next meeting, June 13.

However, the Fed is open to further hikes in July, if necessary, he said.

"Skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming," Fed governor Philip Jeferson said in May.

Interest rates elsewhere

Inflation in Europe, on the other hand, is decelerating. A bigger-than-expected slowdown in May, along with more restrictive credit conditions, will likely embolden calls for a pause on European interest rates hike in July, according to Bloomberg

That would leave the deposit rate at 3.75 percent.

Nonetheless, even the European Central Bank will be leaving the door open for more interest rate hikes in September. President Christine Lagarde herself told lawmakers this week that price pressures remain too strong.

Inflation has not yet peaked, she said.

When inflation peaks, it usually plateaus for a while then begins to decline either shortly afterwards or directly after peaking.

Interest rates are already squeezing the economy in the UK, at 4.5 percent, and markets expect them to exceed 5 percent. A quarter point hike is nailed on for June 22, Bloomberg underlined.

As for Japan, no major shift is anticipated when officials meet on June 16, as inflation is barely above the 2 percent target of the central Bank of Japan..

Still, economists including Goldman Sachs and BNP Paribas expect the BOJ to tighten policy next month, Bloomberg said. Even as Governor Kazuo Ueda insisted that he sees no immediate need to change course.

In the case of Japan, inflation is good for the economy.

He argues that — after years of deflation — the cost of making premature policy adjustments is larger than that of waiting.

After years of deflation, workers’ real wages are still declining, weighing on consumer spending power, he explained. This makes it urgently important to sustain inflation at 2 percent.

Either way, the world is waiting to see what decision the Fed takes in their upcoming meeting, as the US dollar bolsters so many economies and currencies around the globe. Another interest rates hike will affect economies all over the world.