ALBAWABA – In yet another response to the United States (US) escalation of the US-China tech and trade war, the Chinese government imposed export controls on gallium and germanium metals, which drove the stocks of China chips-metal producers higher on Tuesday.

Notably, gallium and germanium are used in the manufacturing of electronic chips, communications and defence technology.

Stocks of the Yunnan Lincang Xinyuan Germanium Industrial Company jumped by the 10 percent daily limit in Shenzhen and Yunnan Chihong Zinc & Germanium Company also hit the mark in Shanghai.

However, Yunnan Chihong Zinc & Germanium Co. shares later declined, according to Bloomberg.

These metals are often byproducts of zinc and aluminum refining processes..

Zhuzhou Smelter Group Co. climbed to the 10 percent limit before losing much of that advance and Yunnan Luoping Zinc & Electricity Co. rose 5 percent, the New York-based news agency reported.

The stocks jumped on expectations that the supply restrictions would fuel massive price rises for these metals. These price hikes would outweigh the drop in export volumes, Li Weiqing, fund manager at JH Investment Management Co., told Bloomberg.

This is the latest move by Beijing in the ongoing tech trade war with the United States (US) and Europe.

The US, last year, imposed a number of export controls on the supply of advanced microchips to China and factories operating in China. Meanwhile, South Korean companies have been engaging in talks with the US to tweak these export controls to allow Korean factories in China to import these advanced chips.

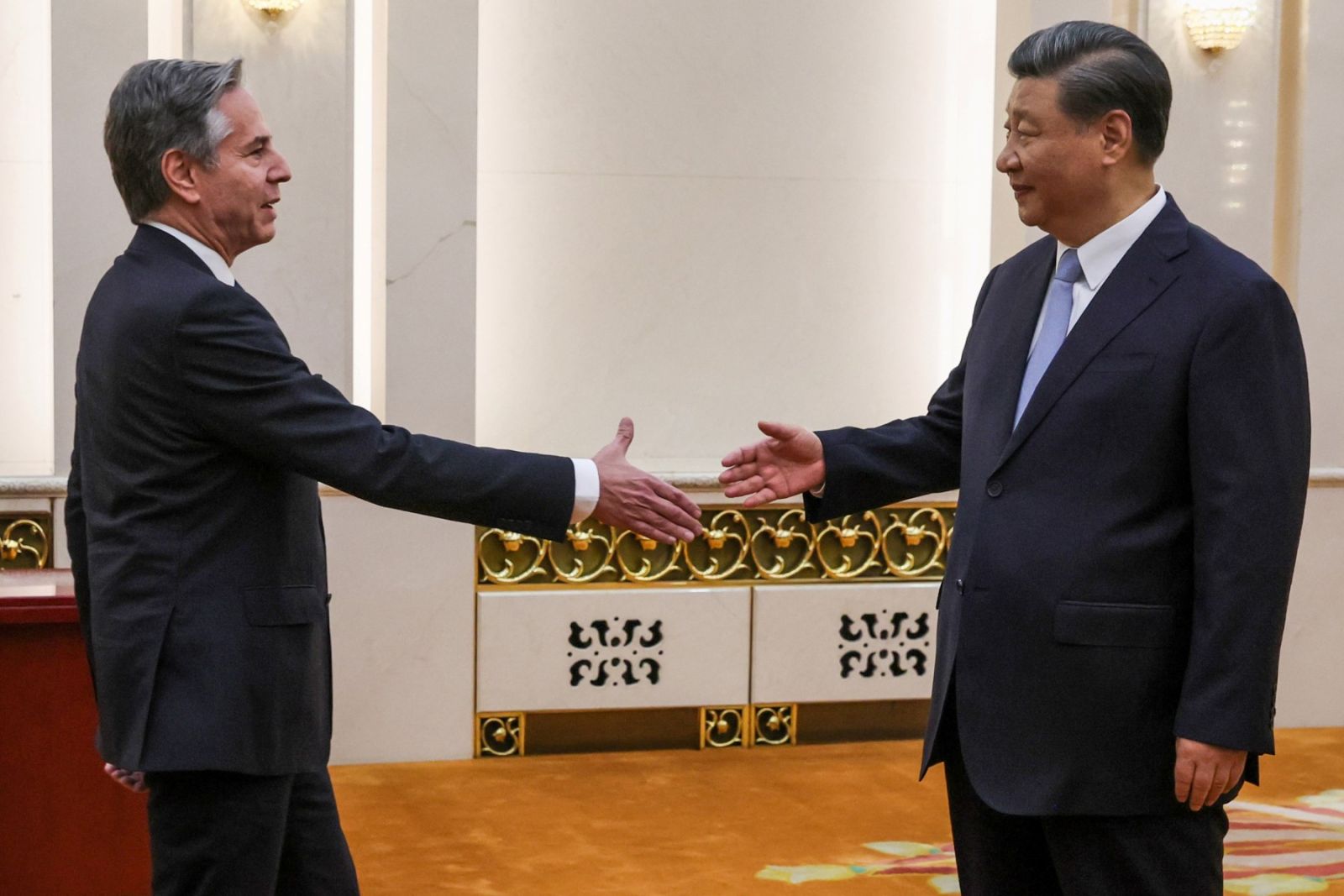

Efforts by US President Joe Biden's administration to restore ties and reopen lines of communication between the two countries have recently seen some leeway with the visit of US Secretary of State Antony Blinken on June 17.

US Treasury Secretary Janet Yellen announced Monday that she will be visiting China later this week, in yet another effort to mend ties.

What does it mean for the US-China tech and trade war

Under these new restrictions, exporters of the two metals will need to apply for licenses from the commerce ministry if they want to start or continue to export them, Bloomberg said.

They will also be required to report details of the overseas buyers and their applications.

The controls are not likely to have a major impact on leading germanium producers, but could be more onerous for smaller operations, said Hu Yan, an analyst at Shanghai Metals Market.

There’s a lack of details on how the curbs will be implemented and Chinese exporters are seeking clarification, she stated to Bloomberg.

The news agency claimed to have attempted to contact Yunnan Chihong Zinc & Germanium, and that they declined to comment. Whereas calls to Yunnan Lincang Xinyuan Germanium and Aluminum Corp. of China Co., which produces gallium, were unanswered.

China controls around 80 percent of the world’s gallium and germanium output, Jefferies LLC analysts, including Edison Lee, said in a note that was obtained by Bloomberg.

Notably, the US relies on imports for over 50 percent of its germanium needs, the analysts said.

The two metals are not particularly rare, but Chinese producers dominate the refining and processing sector.

Japan, South Korea, Russia and Ukraine all produce gallium, while the US, Canada, Belgium and Russia also produce germanium, according to the CRU Group, a metals industry intelligence provider.

Immediate alternatives are not readily available in terms of germanium supply, according to Bloomberg. The US is rich in reserves, but it takes time to build up processing plants.