ALBAWABA – The Turkish banks index soared Wednesday after United States-based investor services firm Moody’s raised Turkey’s banking system’s outlook to stable from negative, Bloomberg reported.

The Borsa Istanbul Banking Sector Index, a gauge that tracks shares of Turkey’s listed banks, reversed losses and rose as much as 4.1 percent to the highest level ever on closing, according to Bloomberg.

It was trading 0.8 percent higher as of 4:42 p.m. in Istanbul.

Moody’s said Tuesday that the turnaround in Turkey’s monetary policies following the presidential elections in May was “positive” and that they supported banks’ operating conditions.

High inflation and a weakening lira may slow economic growth to a projected 4.2 percent at the end of 2023, from last year’s 5.6 percent, affecting banks’ asset quality, the firm’s analysts wrote in the report.

Earlier in August, Moody’s was the first among the world’s top three rating firms to raise the possibility of upgrading the rating of Turkish sovereign debt, citing an improvement in the country’s finances.

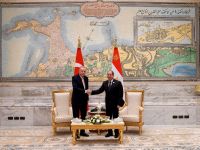

The credit-rating firm also highlighted improvements in Turkey’s standing with foreign investors after President Recep Tayyip Erdogan installed market-friendly bureaucrats to run the $900 billion economy, according to Bloomberg.

Erdogan, prior to appointing former Wall Street bankers in his government after his re-election, adopted growth-at-all-costs policies, which reportedly caused runaway inflation and drove out investors. Turkey also saw a decline in investor holdings of lira-denominated assets at the time.

The new economic administration, led by Finance Minister Mehmet Simsek has since reversed some of Erdogan’s previous policies, while central bank Governor Hafize Gaye Erkan curbing access to credit. The central bank raised the benchmark interest rate by 9 percent to 17.5 percent.

Erkan also promised to unwind regulations that were put in place by her predecessor to force banks to hold more lira deposits, according to Bloomberg.

“The potential for sequencing missteps” in the banks’ efforts to untangle those “macro-prudential measures” represents a key risk for Turkish banks, Moody’s said.

In August 2022, Moody’s raised the outlook on individual Turkish banks’ ratings to stable from negative, in line with its decision on Turkey’s sovereign debt.