S&P Warns Beirut of Sovereign Debt Exposure

International rating agency S&P said Lebanese banks are well-regulated but warned their exposure to the public debt is increasing. “Regulation and supervision are adequate, helping banks to maintain much-needed confidence and sustain a large and resilient customer base. The crowded, but stable, competitive landscape is largely concentrated on a dozen players,” the report explained.

But S&P noted that among the weaknesses of the Lebanese banking sector is its high exposure to sovereign debt.

“Banks bear high exposure to the sovereign, which is the main risk factor for the domestic banking system. The economy is highly vulnerable to internal and external political risk. The economy and banks’ balance sheets are highly dollarized,” S&P added.

Lebanese banks hold a big chunk of the government Treasury bills, Eurobonds and certificates of deposit and this increases the risk of default payment in the future.

But despite the high debt-to-GDP ratio, the Lebanese government has never defaulted on paying its debt.

Lebanon’s annual budget deficit is projected to hit $5 billion at the end of 2018, or almost 9 percent of GDP.

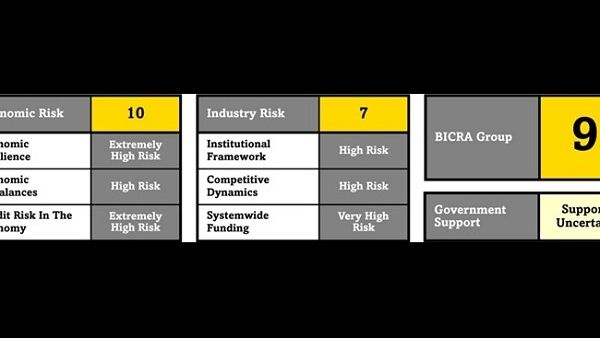

“S&P Global Ratings classifies the banking sector of Lebanon (B-/Stable/B) in group ‘9’ under its Banking Industry Country Risk Assessment. Other countries in group ‘9’ include Argentina, Azerbaijan, Cambodia, Cyprus, El Salvador, Jamaica, Kenya, Papua New Guinea, Tunisia, Uzbekistan, and Vietnam. We consider Egypt, Jordan, Jamaica, Tunisia, and Cambodia to be the closest peers to Lebanon,” the report said.

S&P said it uses BICRA economic risk and industry risk scores to determine a bank’s anchor, the starting point in assigning an issuer credit rating.

The rating agency again highlighted the geopolitical risk factors that influence Lebanon’s rating.

“The regional geopolitical situation, primarily the conflict in Syria, and Lebanon’s divided internal political environment poses significant risks for the Lebanese economy. We think the Lebanese private sector will continue to show resilience, as it has in previous economic crises, although we expect a gradual decline of asset quality in some sectors,” the report said.

It added that the key credit risk for Lebanese banks remains their exposure to sovereign debt.

“The banks continue to use large and resilient, albeit slowing, deposit inflows to buy domestic government debt to finance their structurally high deficits, in turn inflating their balance sheets and exposing them to a single large borrower. At the same time, we consider that the banks are firmly positioned to withstand the gradually deteriorating quality of private-sector loans,” S&P said.

It added that relatively high interest rates coupled with well-regulated banks, have preserved the confidence of investors and depositors.

“Lebanon’s adequate banking supervision and favorable interest rates have been vital to sustaining depositors’ confidence, steady deposit flows, and the government’s financing capabilities. The competitive landscape is crowded but largely concentrated around a stable set of a dozen players that gradually build their presence across the region,” the report said.

“Banks also tend to avoid complex products, meaning that they forego earnings diversification for greater industry stability, in a context of historically low yields on domestic government debt. Funding features a high proportion of retail deposits that have shown resilience through various past crises,” S&P said.

The report did not foresee further economic deterioration this year.

“We assess the trend for economic risk in Lebanon as stable,” the report said.

“Against the weak economic backdrop, banks’ exposure to the structurally highly indebted domestic sovereign dominates their asset portfolios. We continue to see high risk linked to this exposure, especially given the uncertainty of policymakers’ ability to address medium- and long-term macroeconomic reforms. That said, we do not envisage a further deterioration of domestic economic conditions in the next 12-18 months, assuming no major political instability,” the report added.

S&P did not see an end to the political bickering in Lebanon that sometimes delays economic reforms.

“Political risk will continue to be a material weakness. Long-standing political bickering between sectarian factions and an episodic government vacuum are consistently obstructing economic and fiscal policy and decision-making, in turn curbing economic growth potential and lending opportunities for banks,” the report said.

“The recent resignation of Prime Minister Saad Hariri triggered a significant downward reassessment of Lebanese risk by investors as evidenced by prices for credit default swaps. Although the resignation was subsequently reversed, we consider that Lebanon’s current political equilibrium remains fragile,” the report said.