Sharjah Islamic Bank net profits rose by 13% and propose to distribute 10% bonus shares

Sharjah Islamic Bank (SIB) has announced its 2016 financial results and achieved a net profit of AED 462.9 million in 2016 compared to AED 409.9 million last year; a 13% increase. SIB Board of Directors will propose a 10% bonus shares dividend, one share for each existing 10 shares, during the next AGM meeting.

Total assets reached AED 33.5 billion at the end of 2016 compared to AED 29.9 billion at the end of 2015, representing an increase of 12%.

On the asset side of the balance sheet, customer financing reached AED 17.1 billion at the end of 2016 compared to AED 16.3 billion at the end of 2015, an increase of 4.5%. Investment in securities, which mainly represent investment in sovereign and investment grade rated tradable Sukuk, increased significantly by 73.7% to reach AED 4.1 billion compared to AED 2.4 billion at the end of 2015.

Moreover, SIB continues its strategy to maintain liquid assets ratio above 22% of total assets and has reached AED 7.8 billion or 23.4% at the end 2016. Displaying a strong liquidity position, during May 2016 SIB repaid a Sukuk amounting to USD 400 million through its own sources, before issuing the latest Sukuk last September.

On the liability side, despite the tight liquidity during the year, SIB successfully attracted more customer deposits during the year to reach AED 18.3 billion growing by AED 1.4 billion or 8.1% compared to AED 17.0 billion at the end of 2015.

As part of the SIB’s ongoing strategy to continue to diversify the funding sources, the bank has successfully issued a new five years Sukuk of USD 500 million during September 2016, as part of USD 3 billion medium terms Sukuk approved programme. SIB currently has three outstanding Sukuk totaling USD 1.5 billion.

This transaction is testament to investors’ confidence in SIB’s long term operating model and business strategy, and represents another key milestone in the bank growth strategy.

Lending to stable deposits ratio (LSRR) reached 69.3%, which is well below the Central Bank requirement.

SIB is strongly capitalized with a strong capital adequacy of 21.35% as at 31 December 2016. Shareholders’ equity reached AED 4.9 billion or 14.5% of total assets.

Non-performing receivables/NPL’s ratio has improved and declined from 6.3% to 5.9%. Despite this improvement SIB has strengthened its financial position by increasing the provisions coverage ratio to reach 100.1% of the NPL’s in 2016 as compared to 86.1% in 2015.

On the income statement side, despite the impact of SIB’s improved coverage ratio, SIB has made an additional provision of AED 254.8 million and reported a net profit of AED 462.9 million in 2016 compared to AED 409.9 million in 2015.

As a result of these achievements, Return on Average Shareholders’ Equity (ROAE) reached 9.68% by the end of 2016 compared to 8.82% in 2015, while Return on Average Assets (ROAA) stood at 1.46% by the end of 2016 compared to 1.47% in 2015.

Earnings per share stand at AED 0.19 for the year 2016, as compared to AED 0.17 for the year 2015, an improvement of 11.8%.

KEY ACHIVEMENTS:

During the year 2016, SIB has successfully changed its core banking system to meet the upcoming technological business transformations and provide outstanding customer services while focusing on increasing its online transaction processing.

During the year 2016, branch network of the Bank increased from 31 to 32 and the number of ATMs increased to 127 as compared to 116 in 2015.

SIB maintained its leading role in corporate social responsibilities; during 2016 SIB supported and donated to a number of healthcare, educational, cultural, social, humanitarian, sport and environmental entities, that service and help develop local communities.

During the year 2016, SIB has bagged the following awards to its name:

- Sharjah Islamic Bank wins “Best Islamic Bank IN UAE – Islamic finance category - world finance award;

- Sharjah Islamic Bank CEO shortlisted for Mediaquest Magazine's Top 100 CEOs award in the GCC;

- Wells Fargo "Straight-Through Processing Award;

- Best Professional Practices in Internal Audit in the Private Sector' award under the "Governance, Risks and Control" Category, at the 6th Chief Audit Executive Conference in Abu Dhabi.

Background Information

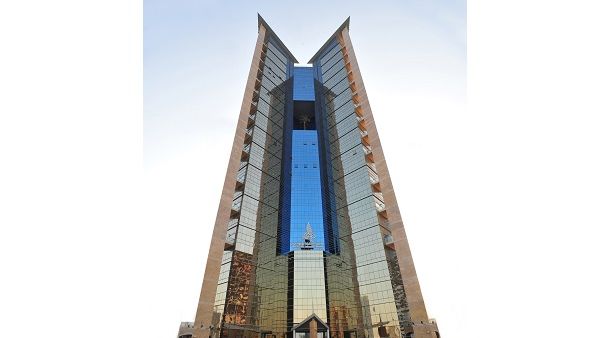

Sharjah Islamic Bank

We believe in our vision and values just as strongly today as we did the first time we put them on paper more than 30 years ago.

Sharjah Islamic Bank (SIB) started servicing the society in 1975; providing banking services to individuals and companies. An Amiri decree; released by His Highness Dr. Sheikh Sultan Bin Mohamed Al Qassimi the member of the Supreme Council & Ruler of Sharjah, was issued to launch & green-light the bank’s expedition. The bank was originally founded as National Bank of Sharjah and was suited the first bank to convert to Islamic Banking in 2002.