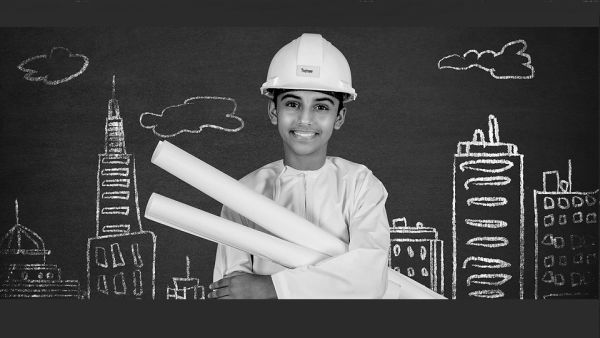

Celebrate Every Milestone With Muzn’s Kids Wakala Savings Account

Nothing is more important to parents than their child‘s future security and thanks to Muzn, National Bank of Oman’s Islamic Banking Window, it’s never been easier. Open to kids from one day to 18 years old, the Kids Wakala Account offers numerous benefits including attractive saving options with a healthy return on investment, in addition to Takaful cover designed for peace of mind. It’s all part of Muzn’s aim to meet the evolving needs of its customers while making Islamic banking accessible to all.

Salima Al Marzouqi, Chief Islamic Banking of Muzn, said, “At Muzn we aim to be part of our customers’ financial journey throughout their lives. We understand that now more than ever, people want to make sure they secure a bright future for their children, which is why our Kids Wakala account has been designed to ensure that their financial future is protected against unforeseen circumstances. Backed up with the support of our dedicated team and personalised service, we are committed to providing solutions that meet our customers’ financial requirements and religious beliefs”

Open to Muzn customers and non-customers alike, the Kids Wakala savings account is available for children up to 18 years of age. The account comes with Takaful Life and permanent disability risks coverage with a double deposit benefit up to OMR 75,000. This means that in case of a claim, the Takaful Insurance company shall pay an extra amount equal to the deposit as a benefit for the child. Hence, the more amount you deposit the more , peace of mind you get in case the unexpected happens.

As the first Islamic Banking Window in Oman, Muzn provides an all-encompassing range of Shari’a-compliant banking services to deliver financial solutions to a growing customer base. The bank offers innovative, competitive and quality Islamic banking products and services while ensuring they are accessible to all.

Background Information

National Bank of Oman

Founded in 1973, National Bank of Oman was the country’s first local bank, forging a rich history with Oman’s local businesses and its economy at large. Today, it is one of the largest banks in Oman, with a paid up capital of OMR (Omani Rials) 110.8 million (US$ 288 million) and a regulatory capital of OMR 377.8 million (US$ 981 million)*.