Burgan Bank Group posts Net Profits of KD 31.2 million for the first half of 2012

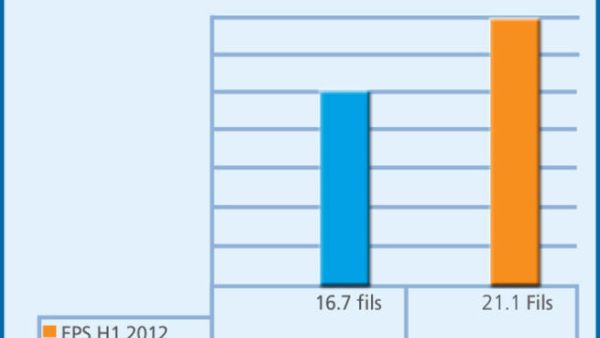

Burgan Bank Group announced today its earnings results for the first half of 2012. Net profits grew by 23% to reach KD 31.2 million for the period ending June 30, 2012, from KD 25.3 million reported in the same period last year. Earnings per share (EPS) stood at 21.1 fils compared to 16.7 fils in 2011. While Provision charges reported at KD 15.5 million.

The group continues to report quarter– to-quarter Solid performance reflecting a healthy growth trend. While comparing with the same period of 2011, the second quarter in 2012 reflected a growth of 13% in Operating income to reach KD 48.1 million.

Comparing the growth from the first quarter of 2012, the group realized an annualized growth of 16% in Customer deposits to reach KD 3,164 million while loans and advances annualized growth stood at 31% to reach KD 2,592 million. Non-performing loans ratio (Net of collateral to gross loans) was reduced to 2.8%.

The consolidated financials encompass the results of the group’s operations in Kuwait, and its share from its regional subsidiaries, namely Jordan Kuwait Bank, Gulf Bank Algeria, Bank of Baghdad, Tunis International Bank, in which Burgan Bank has a majority stake in.

Burgan Bank’s Chairman, Mr. Majed Essa Al-Ajeel said: “We are pleased with our results for the first half of 2012. Our consistent positive performance in Kuwait and across the markets in which we operate from is backed by a strong & excellent execution of the strategy and a business model that has proven to be resilient to a less favorable economic and business climate. The group’s subsidiaries remain profitable, and synergies among the group members started to pay-off by which cross business origination has been increasing noticeably and as per planned. Burgan Bank Group’s key leading financial indicators are pointing to the right direction”.

“On behalf of the board, I take this opportunity to thank the Central Bank of Kuwait, our customers and shareholders for their confidence in our capabilities. I would also like to thank our executive management team for their leadership and the excellent execution of the strategy, and to our staff for their continued support and commitment,” concluded Al-Ajeel.

Background Information

Burgan Bank

Established in 1977, Burgan Bank is the youngest conventional Bank and second largest by assets in Kuwait, with a significant focus on the corporate and financial institutions sectors, as well as having a growing retail, and private bank customer base. Burgan Bank has majority owned subsidiaries in the MENAT region supported by one of the largest regional branch networks. which include Gulf Bank Algeria - AGB (Algeria), Bank of Baghdad - BOB (Iraq & Lebanon),Tunis International Bank – TIB (Tunisia), and fully owned Burgan Bank – Turkey, (collectively known as the “Burgan Bank Group”). Furthermore, Burgan Bank has a present in the UAE through its corporate office (“Burgan Financial Services Limited) which had helped the bank to participate in multiple financing opportunities in the UAE.