AXA Gulf Continues to Strengthen Key Partnerships

AXA Gulf was recently recognised by Dubai Chamber with a Certificate of Appreciation during their 2020 Supplier's Appreciation Ceremony.

Commenting on the occasion, Paul Adamson, CEO of AXA Gulf, said: "AXA is revolutionising the concept of prevention to encourage employees to engage in our vision for the future of healthcare. As a key strategic partner to Dubai Chamber, we are able to showcase how preventative care, focused on health and wellbeing can offer insight, reassurance and peace of mind with the ultimate aim of improving employees' productivity. This award highlights our commitment to innovation and strengthens our partnership with Dubai Chamber for the future."

Knitted into the region’s fabric since 1950, AXA Gulf bridges its knowledge of the region’s healthcare challenges and risks with international healthcare industry expertise, making it a key strategic partner to the Dubai Chamber since 2012. AXA Gulf continues to modernise and expand on its offering based on the shifting market needs. Today, they are not limited to Group Healthcare, but include Group Life and P&C products (Property All Risk, General Public Liability & WC). Given the strong partnership built with the DCC management, AXA Gulf has piloted several successful offerings on their premises, including the recently awarded Health On Track programme and the innovative Medical Consult Station, further empowering its transformation from PAYER to INSURANCE PARTNER of CHOICE.

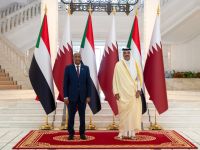

Image Caption: From Left to Right – Rawan El Habbas, Paul Adamson, H.E. Atiq Juma Faraj Nasib, Laura Gerstein Alvarez, Ramon Perez Goicoechea, and James Toyne

Background Information

AXA Gulf

VAT or Value Added Tax is a form of consumption tax that is imposed on a transnational level. The GCC has agreed to apply a uniform standard rate of 5%. This standard rate will apply to almost all domestic transactions. UAE and KSA will implement VAT on 1 January 2018, and the other GCC countries are expected to implement in the following 12 months.

In limited instances VAT can also apply at 0% (zero-rate), or transactions can be exempt from VAT, or out of scope.

How it works is that taxable businesses are generally able to recover the VAT they incur on their purchases and expenses.

However, as individuals, we are the final point of the supply chain and therefore, will bear the cost as we are not able to recover the VAT.