IEA projects stronger crude demand towards end of 2023 than expected as oil prices rise on hopes of China's economy recovering

ALBAWABA – Oil prices surged on Wednesday on the heels of surprisingly positive economic data from China and the US dollar sliding to the lowest level in months.

The United States (US) dollar tumbled by the most in a year after slower US inflation data led consoled traders that the Federal Reserve will start cutting interest rates by mid-2024, Bloomberg reported.

Treasury yields plunged and the US dollar lost as much as 1.3 percent on Tuesday, the largest such drop since November 2022.

Meanwhile, China’s factory output and retail sales are up in October, according to official data released one day after the International Energy Agency (IEA) raised its oil demand growth forecast for 2023, to 2.4 million barrels per day (bpd). Compared to 2.3 million bpd forecast in September.

Brent futures rose $0.20, or 0.2 percent, to $82.67 a barrel by 0427 GMT, according to Reuters, while West Texas Intermediate (WTI) crude rose $0.15, also by 0.2 percent, to $78.28.

China's October economic activity perked up as industrial output grew at a faster pace and retail sales growth beat expectations, an encouraging sign for the world's second-largest economy.

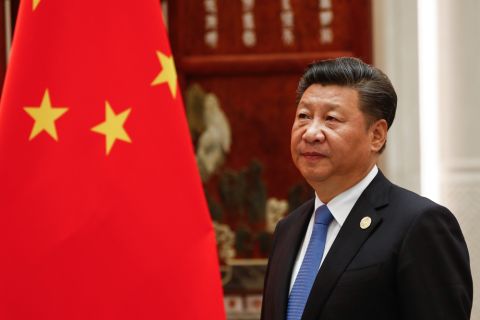

The US Dollar slipped by the most in a year as gold prices picked up on stronger economic data from China - Shutterstock

On the global frontier, the IEA finally raised its expectations for oil demand growth this year, following in the steps of the Organization of the Petroleum Exporting Countries and its allies (OPEC+).

Despite projections of slower economic growth in many major countries, both the IEA and OPEC+ now agree that demand is likely to grow towards the end of the year, placing further pressure on supplies. Especially with Saudi Arabia and Russia maintaining their cuts until the end of 2023, which will also likely bolster oil prices.

The United States (US) Energy Information Administration (EIA) will release its first oil inventory report in two weeks on Wednesday. EIA did not release a storage report last week due to a systems upgrade, Reuters reported.

For the week ended November 10, analysts forecast energy firms added about 1.8 million barrels of crude into US stockpiles, according to a Reuters poll. In line with a report from the industry-funded American Petroleum Institute out Tuesday.