ALBAWABA – Markets around the world rose Thursday, June 1, on news of the United States (US) House of Representatives passing the US debt ceiling deal, as reported by Agence France-Presse (AFP).

Asian investors largely welcomed the passage. Hong Kong, Tokyo, Sydney, Singapore, Wellington and Mumbai all rose, while Shanghai held just above water. Whereas Seoul, Manila, Bangkok and Taipei struggled, according to AFP.

In Europe, London, Paris and Frankfurt rose at the open.

In initial deals, London's benchmark FTSE 100 index of major blue-chip firms won 0.3 percent to 7,471.77 points compared with the closing level on Wednesday.

Likewise, Frankfurt's DAX added 0.8 percent to 15,782.70 points and the Paris CAC 40 gained 0.8 percent to 7,154.83.

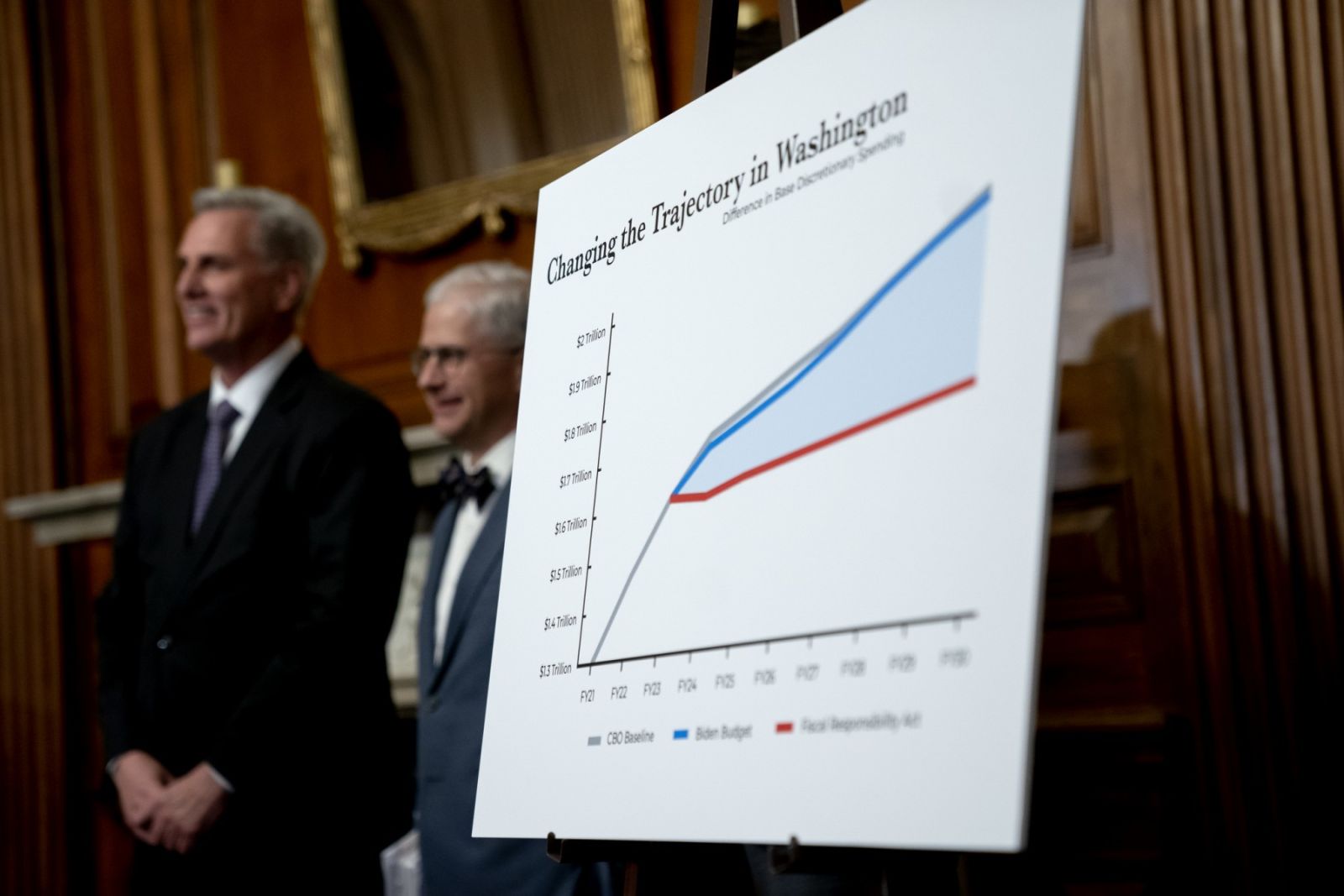

An overwhelming majority of the House, including both Democrats and Republicans voted in favour of the bill to suspend the US debt ceiling limit until 2025.

Markets are bullish as signs that the bill will pass the next step, the US Senate, are promising.

Although President Joe Biden and House Speaker Kevin McCarthy did warn of delays, it remains vital that the deal clears Congress before June 5. Otherwise, the US will be out of cash and will surely default on its bills and debts, due June 1, for the first time ever in history.

After US debt ceiling deal, markets look to Fed

While the threat of a US default may be receding for now, traders and investors continue to worry about the prospects of the Federal Reserve Board (the Fed) raising interest rates soon, AFP reported.

Since 2022, the Fed raised interest rates by nearly 5 percent, and some analysts and experts expect further rate hikes, up to 6 or 6.5 percent.

Focus will now turn to the release of US May jobs data on Friday.

Strength of the labor market is a key factor in the Fed's decision to keep hiking rates for more than a year as it tries to rein in inflation.

According to the Phillips Curve, an economic model for understanding the relationship between the labor market and inflation, the higher the employment rates, the higher inflation is, and vice versa.

So far, data showing an unexpected jump in job openings on Wednesday did little to soothe investor concerns over raising interest rates.

According to AFP, this is a preferred inflation gauge for the Fed.

Should the May jobs report show further growth in the labor market, as did the April report, the Fed may be inclined to raise interest rates during their meeting in June.

Nonetheless, AFP reported messages by officials suggesting the pause on further rate hikes may continue through June.

Key market figures as reported by AFP

Tokyo - Nikkei 225: UP 0.8 percent at 31,148.01 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 18,249.50

Shanghai - Composite: FLAT at 3,204.63 (close)

London - FTSE 100: UP 0.2 percent at 7,461.78

Euro/dollar: DOWN at $1.0682 from $1.0695 on Wednesday

Dollar/yen: UP at 139.72 yen from 139.30 yen

Pound/dollar: DOWN at $1.2440 from $1.2442

Euro/pound: DOWN at 85.86 pence from 85.93 pence

West Texas Intermediate: UP 0.7 percent at $68.55 per barrel

Brent North Sea crude: UP 0.8 percent at $73.17 per barrel

New York - Dow: DOWN 0.4 percent at 32,908.27 (close)