Deposits in top 4 US banks, including JPMorgan, amount to nearly $6.1t

ALBAWABA – Renowned bank JPMorgan Chase and Co. has taken the lead on banking deposits in the United States (US) with more than 10 percent of total US banks' deposits as of 2022, according to CNBC Arabia.

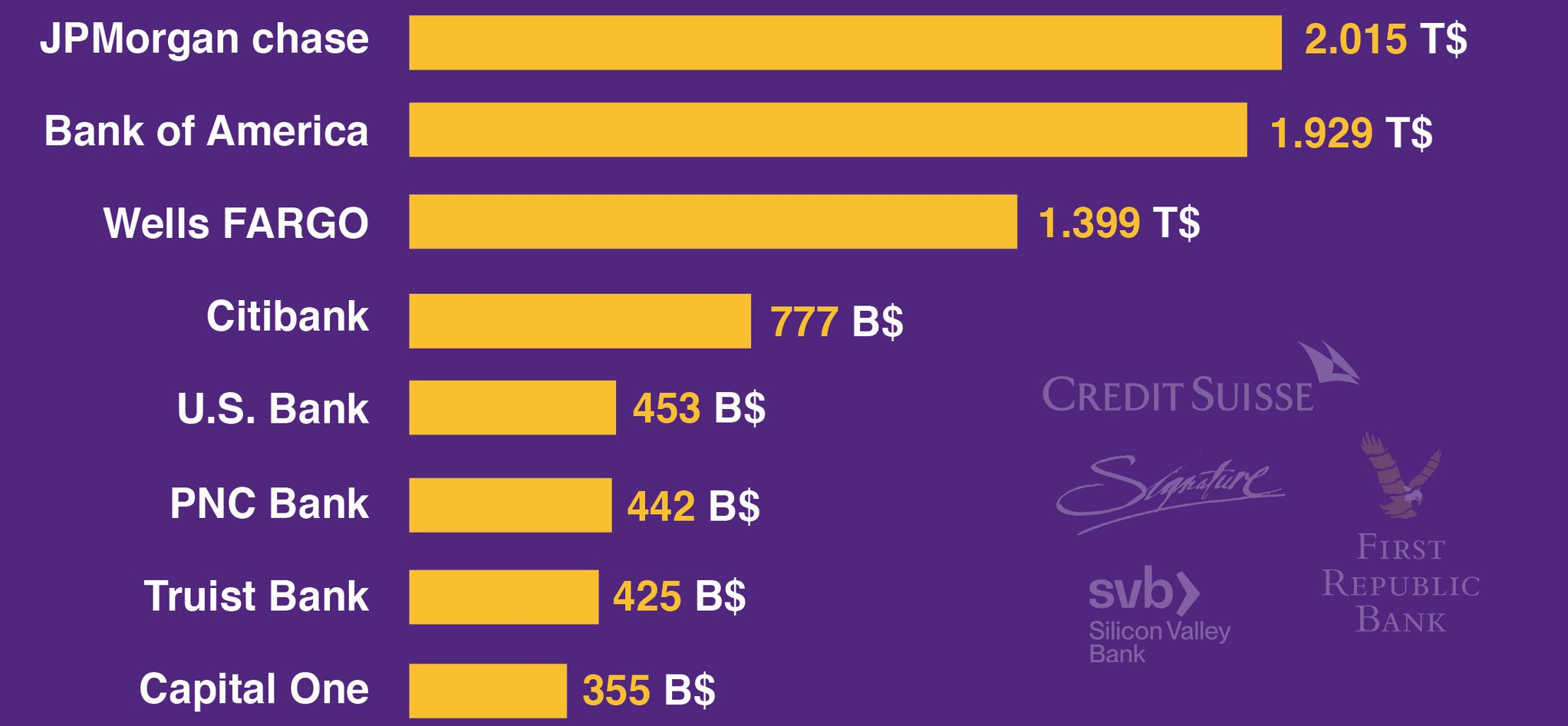

The bank is considered the largest in the US, with more than $2 trillion in deposits as of 2022.

After the collapse of the First Republic Bank, the Federal Deposit Insurance Corporation announced that JPMorgan will step in to acquire most of the failed bank’s assets.

The deal is expected to be finalized before the end of May, as reported by CNBC Arabia.

JP Moran will assume about $92 billion in deposits, including the $30 billion in bailout deposits from large banks, including the banking mammoth’s own deposits.

These bailout deposits were part of an attempt by large banks in the US to bail out, or rescue, First Republic Bank in March, but to no avail. The amounts are to be repaid to the banks or cancelled, once the deal is completed.

Normally, banks of JPMorgan’s size are not allowed to make further acquisitions under federal law. But the rule does not apply to acquiring failed banks, according to CNBC Arabia.

The combined domestic deposits of JPMorgan, Bank of America, Wells Fargo, and Citybank, stood at $6.1 trillion as of December 2022. Which is larger than the combined deposits of the 33 closest competitors in the US banking sector at the time.

Over the course of five days in March 2023, three small and mid-sized US banks failed.

This triggered a sharp decline in global bank stock prices and a swift response by regulators to prevent a potential global financial contagion.

Silvergate Bank and Signature Bank failed in the midst of turbulence in that market. Both risked significant exposure to cryptocurrency.

Silicon Valley Bank (SVB) failed when a bank run was triggered after it sold its Treasury bond portfolio at a large loss, causing depositor concerns about the bank's liquidity.