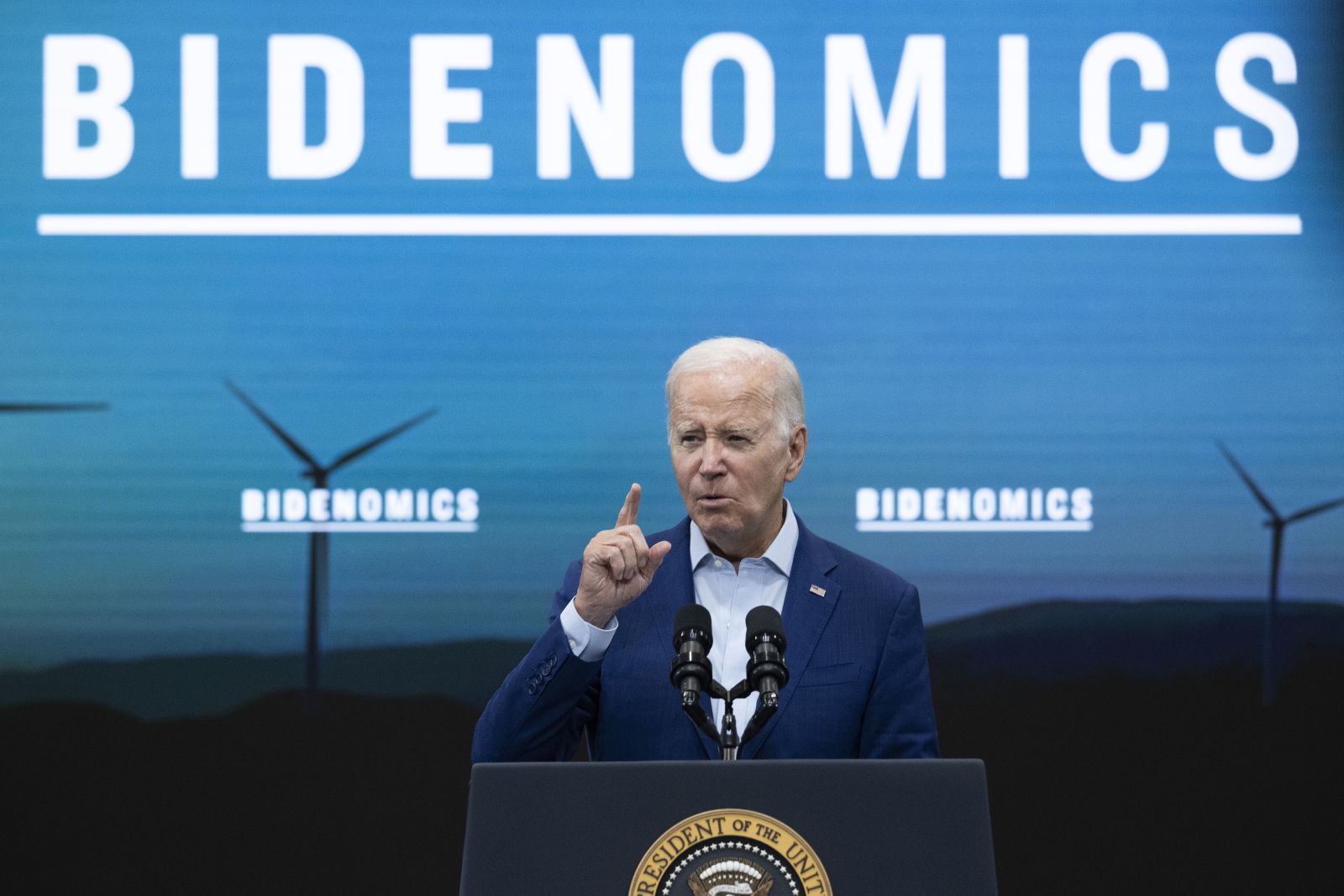

ALBAWABA – United States (US) President Joe Biden launched the US climate plan exactly one year ago, with billions allocated to bolstering greener locally sourced energy and transportation options. But how has it affected US trade ties?

Launched on August 16, 2022, and dubbed the Inflation Reduction Act (IRA), the plan directs some $370 billion in subsidies towards the US energy transition. Such subsidies included tax breaks for US-made electric vehicles and batteries.

These incentives are intended to boost American manufacturing, after many years of offshoring and outsourcing.

However, they seem to have triggered concerns about drawing business out of other countries and back into the US.

"This was really the United States coming into the game in a big way," Joshua Meltzer, senior fellow at the Brookings Institution, told Agence France-Presse (AFP).

Europe had been subsidizing the development of clean technologies since before the IRA, as had China and others, Meltzer noted. But Washington's entry "meant that for these subsidies to remain competitive they had to be continued or raised," he explained to AFP.

Unintended consequences of the US climate plan

No doubt, Biden’s legislation has had some “unintended consequences” in terms of constraining trade with key US allies, according to Jeffrey Schott, senior fellow at the Peterson Institute for International Economics.

The consumer tax credit of up to $7,500 for the purchase of electric vehicles assembled in North America really stuck with AFP’s analysts.

To qualify for the full credit, the batteries of the vehicles consumers buy should also have a percentage of critical minerals sourced from America or countries with which it has free-trade pacts. These pacts do not include – as of yet – the European Union (EU) and Japan.

US allies protested the law, raising concerns about being left out in the cold.

Eventually, US officials expanded access to these subsidies in March to include newly negotiated critical minerals deals, which helped Japan tap into some of the subsidies of the IRA, but only some. Not all.

"Part of the initial friction was because... the last revisions of the IRA were done in haste and in secret," said Schott.

There appeared to be a "lack of understanding that US allies were not all US free-trade partners," he added. To chip in allies on the benefits of the law, the Treasury Department had to do some "creative accounting" in terms of defining how the law would be implemented.

Meltzer said Washington "quite quickly tried to respond to these concerns by negotiating this kind of bilateral deals", speaking about the deal with Japan and the one the EU is trying to secure with the US.

Impact of the US climate plan on partnerships and relocations

Canada, which warned about the risks of a subsidy war, has since responded by matching certain IRA incentives with those of its own, according to AFP.

In April, it announced up to $9.8 billion in subsidies over 10 years for Volkswagen's first overseas battery plant in Ontario.

Meanwhile, South Korea's largest automaker Hyundai is hoping to produce US-assembled electric cars eligible for subsidies at a site under construction in Georgia.

Other South Korean companies have forged partnerships with US companies to build assembly lines in accordance with IRA requirements. Examples of such partnerships are battery makers Samsung SDI's joint venture with General Motors to build an EV battery plant in the US.

"The IRA would benefit the US through additional output and lower strategic dependence vis-a-vis China," said an analysis by three European Central Bank economists in July.

"The US would gain from positive relocation effects, increasing production by six percent to 30 percent in electrical and optical equipment," the economists said in a column on the Centre for Economic Policy Research's policy portal.

This comes mainly at China's expense, and to a smaller degree the EU's, the economists said.

While the relocation involves a relatively small share of total output, losses in specific sectors can be more substantial, according to AFP.

Since August last year, at least $75 billion in new manufacturing investments have been announced, according to policy analyst Jack Conness of think tank Energy Innovation: Policy and Technology.

Also, IRA green subsidies may be "of similar size" to those available in the EU, but the US clean-tech subsidies are "simpler and less fragmented," said European think tank Bruegel in a report this year.

Other factors could make US subsidies more attractive to businesses than the EU’s, such as rising energy costs following Russia's invasion of Ukraine.

"If you're in an energy-intensive sector such as chemicals... the US looks increasingly attractive," Meltzer said.

"It's a broader set of factors, I think, that are creating competitive challenges in Europe," he said. "The IRA is a part of that... but it's not everything."