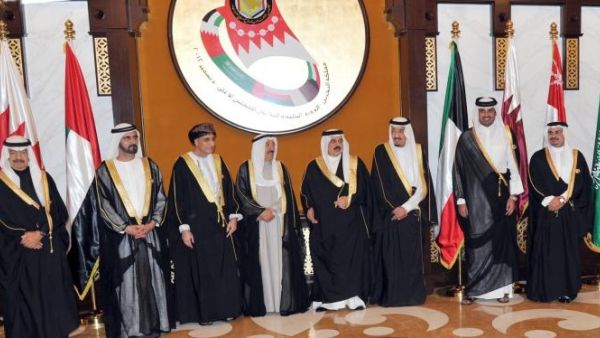

The fact that Kuwait, a member of the Gulf Cooperation Council (GCC), hosted the third Arab-African summit last week is a notable development.

Possibly, gone are the days when the deposed Libyan leader, Muammar Gaddafi, would serve as a host of pan-Arab and African meetings. The Libyan city of Sirte hosted the second Arab-African summit in late 2010 only weeks prior to the eruption of the Arab Spring. Colonel Gaddafi himself could not survive the waves that burst through in the wake of the tumultuous event.

The meeting in Kuwait took place on the theme of ‘Partners in Development and Investment’. The host country was quick to translate the message into deeds.

On the eve of the summit, Kuwait’s Emir, Sabah Al Ahmad Al Sabah, pledged $1 billion (Dh3.67 billion) in low-interest loans to African countries for a period of five years. It is possible that other resourceful GCC countries, with special funds for global development, would follow suit.

Africa needs investments in energy, infrastructure such as power and telecom, and agriculture. In turn, GCC countries have the necessary financial resources to address the continent’s development needs.

The Sovereign Wealth Institute estimates the funds available to GCC countries as hovering around $1.8 trillion. This sizable estimate accounts for more than a third of all SWFs in the world.

By one account, Africa requires some $30 billion a year to meet investment requirements in the fields of energy and power. Certainly, GCC countries with their formidable resources and experience in the petroleum sector can help Africa tap its oil reserves.

It is suggested that the continent controls about 12 per cent of the world’s proven oil reserves.

In reality, GCC telecom firms have already assumed market leadership in certain African territories. Etisalat has investments in Zantel, a key telecom provider in Tanzania. Also, not long ago, Zain of Kuwait made a fortune from selling assets owned in telecom firms in Africa to Bharti Airtel of India.

It is hoped that subsequent meetings similar to the one held in Kuwait would pave the way for an Arab-African common market, together encompassing a combined population of 1.2 billion. Undoubtedly, clinching a common market deal is a daunting task given the diverse issues facing African and Arab nations.

Nonetheless, the meeting in Kuwait provides GCC countries a new push for further upgrading an existing trade deal with a key entity in Africa. In 2010, the six-nation GCC signed a MoU aimed at enhancing commercial and economic cooperation with the Common Market for Eastern and Southern Africa (Comesa).

Headquartered in the Zambian capital of Lusaka, Comesa compromises 19 members with a shared population of around 400 million. Comesa member states occupy 12 million square kilometres, or 40 per cent of the continent’s land area. As such, the Comesa group holds prospects for meeting part of GCC’s agricultural requirements.

To date, Sudan in particular has been attracting investments in the farming business by making use of the latest technologies, in turn designed to satisfy part of GCC’s food imports. Certainly, prospective African markets need to compete with Asian countries seeking a similar type of alliances with GCC investors.

Geography is always a factor when it comes to trade deals, something visible elsewhere in the world. In fact, some African countries are close neighbours to GCC states, providing an added sense to forming strong business ties.

One way forward is turning the MoU signed with Comesa into a concrete trade deal for the mutual benefits of both sides.

By: Jasem Ali

The writer is a Member of Parliament in Bahrain.